[ad_1]

Introduction

The Coresight Research team attended and participated in this year’s Groceryshop conference, held on September 19–22, 2022, in Las Vegas, US. The event brought together retail leaders and industry experts from around the world to explore the changing grocery landscape and address current challenges.

We present our top insights from day four of Groceryshop 2022 on September 22.

Groceryshop 2022 Day Four: Coresight Research Insights

Building Long-Term Customer Loyalty for CPGs and Grocers

Ken Fenyo, President, Research & Advisory at Coresight Research, was joined by a panel of industry experts at Grocersyhop to explore how CPG and grocery companies can build long-term customer loyalty, particularly in the current challenging macroeconomic environment.

The panel emphasized that flexibility will be key. So far, loyalty has been built on what we think consumers value—now, retailers must incorporate what really matters. Fenyo identified a major gap in consumer personalization, emphasizing that there is much room to improve in terms of providing products and content that is contextually relevant to consumers. Partnerships can be critical to enhancing loyalty efforts—yet, historically, companies have wanted to build their loyalty programs themselves.

Source: Coresight Research

Cheryl Munce, SVP, Retail Media & E-Commerce Sales Strategy at Smarty Pants Vitamins (Unilever), emphasized the importance of building a rapport with shoppers in order to develop a sense of community. She also addressed techniques for building loyalty online and offline: the consumer, she stated, is an everywhere consumer, and retailers must get creative to reach consumers memorably with a consistent message across channels.

Sofia Laurell, Co-Founder and Co-CEO of Tiny Organics, highlighted that the experience and emotional bond with consumers is beyond transactional. To build on this, Laurell hosts supper clubs for Tiny Organics—currently via video calls, but soon in person again.

Source: Coresight Research

Five Untapped Opportunities and Channels for Growth

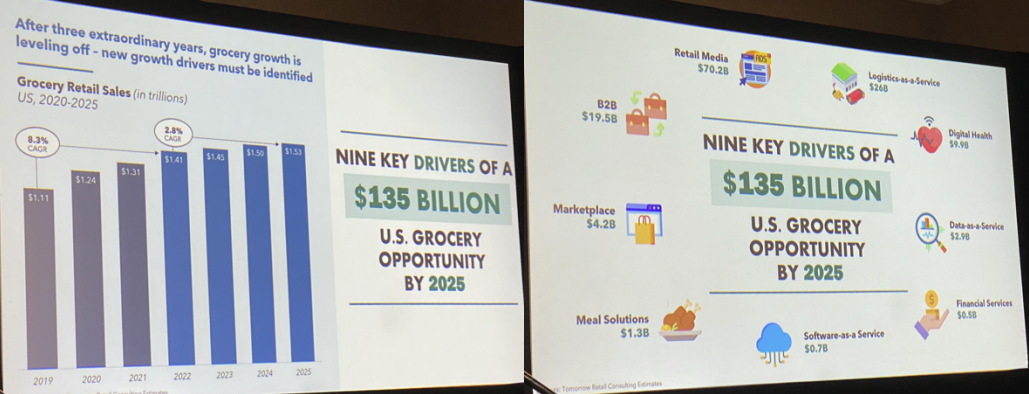

On the final day of Groceryshop, many discussions focused on untapped opportunities and channels for future growth. We identified five opportunities that gained significant attention: how to improve brand and retailer relationships; experimenting with alternative business models such as B2B; tapping into the health and wellness trend; scaling new products and initiatives; and leveraging retail media.

Source: Tomorrow Retail Consulting/Coresight Research

1. Brand-Retailer Relationships

During one of the first discussions of the final day of Groceryshop 2022, Stephen Mewborn, Partner at Bain & Company, discussed the challenges of changing brand-retailer relationships. One of the most notable changes is the rapid growth of online grocery, which is pressuring retailers’ profit margins and surety of supplies, as well as their ability to achieve ambitious environmental, social and governance (ESG) goals. It is also changing how brands can drive growth, as brands need to produce more targeted, precise and personalized marketing, improve the shopper journey, test products quickly to innovate and tackle distribution problems.

Mewborn stated that only one-third of joint business plans currently create value for both sides. Negotiating a new settlement will be difficult, as both sides will need to cultivate new capabilities, develop new methods of collaboration and build greater trust, he emphasized. The traditional low-margin, business-to-consumer (B2C) model will need to be upgraded with new profit pools, such as by launching a B2B model, driving higher margins and using digital assets.

Kroger has made changes to distribution and fulfillment to improve its business model, according to Bill Bennett, VP, Head of E-Commerce at Kroger. The company has launched six fulfillment centers and 12 automated “spoke” centers, and it has entered six new markets, since the 2018 announcement of its exclusive US partnership with Ocado.

Bennett and Brian Rudolph, Co-Founder and CEO at food manufacturer Banza, discussed the importance of brands and retailers aligning incentives and planning through open discussion. Rudolph noted that retailers that are easily able to provide access to sales data are much easier for partners to work with, and enable Banza to better allocate inventory.

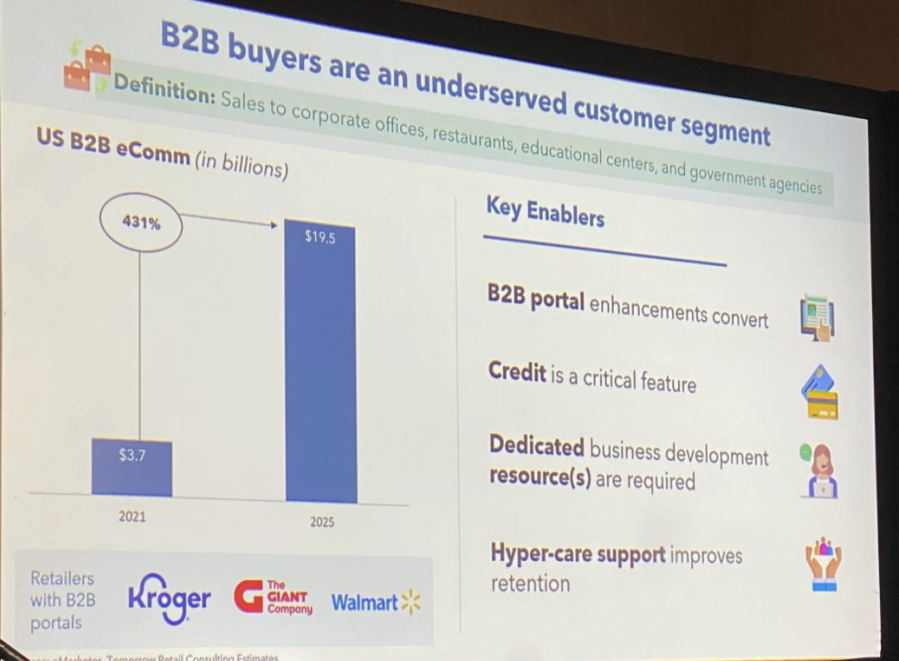

2. B2B

Jordan Berke, Founder and CEO of Tomorrow Retail Consulting, presented several untapped growth opportunities for retailers, as the rapidly evolving retail environment requires new strengths and capabilities. Berke stated that e-commerce has leveled the playing field in B2B and generated greater opportunities for grocery retailers. He also highlighted data as an opportunity for growth. Currently, data is a significant pain point for retailers that are unable to get clean, consistent data, presenting an opportunity for grocers that possess this data.

Berke also highlighted health and wellness (discussed in detail in the next section) as a key opportunity. In order to seize these opportunities, retailers in the grocery space must be willing to prioritize drivers of growth, whether financial, strategic or operational.

Source: Tomorrow Retail Consulting/Coresight Research

Andrew Lederman, Head of BEES Marketplace, AB InBev, discussed the importance of business innovation and collaboration in developing and optimizing B2B capabilities, not only through technology but also through the business process. Lederman emphasized the importance of internal roadshows for BEES Marketplace, in which pilots and case studies enable the numbers to speak for themselves.

3. Health and Wellness

Chris Foltz, Chief Innovation Officer at Heinen’s Grocery Store, spoke about how Heinen’s is delivering health and wellness solutions to consumers in a simple and accessible way: Heinen’s is positioning itself as a translator and connector for consumers to health and wellness products, such as supplements and food solutions. Heinen’s is also focusing on the health of the body and mind through Club FX, a free program for Heinen’s Tasteful Rewards members that offer nutrition tips, recipes, discounts and partnerships with chiropractors, yoga studios and fitness centers.

Source: Company website

4. Scaling New Products and Initiatives

Kelly Edwards, Partner at Bain & Company, discussed the main challenges of marketing and scaling new products and initiatives: developing a winning brand strategy; creating new connected consumer experiences; marketing in a recession; modern marketing operations; and promotions strategies.

Edwards presented four tips to tackle these challenges:

- Brands and retailers should anchor their strategy in a business objective by identifying a high-value opportunity—for example, that marketing effectiveness will improve by 20%.

- Brands and retailers should co-create plans.

- Retailers should take a number of steps to conduct marketing experimentation effectively, from producing test designs and setup to drawing insights and codifying the process.

- Brands and retailers should experiment with marketing locally but scaling globally.

Executives from Spread The Love Foods, BJ’s Wholesale Club and PepsiCo Ventures Group participated in a panel discussion and shared their experiences.

Heather Hacker, VP of Digital Experience & Programs at BJ’s Wholesale Club, spoke about how BJ’s is piloting delivery schemes and new health and wellness products. BJ’s has seen BOPIS (buy online, pick up in-store) growth. In health and wellness, the retailer has observed that consumers are shopping for particular diet types and responded by making changes in its merchandising and data analysis. Hacker stated that it is important to set key performance indicators (KPIs)—measurements for success and identifications of failure—and explained that when BJ’s was testing new shipping promotions, it did not set its KPIs correctly: orders boomed but average order volume dropped.

Daniel Grubbs, Global Chief Venturing & Investment Officer at PepsiCo Ventures Group, stated that Pepsi has been looking into soda products in functional health areas such as brain health and gut health.

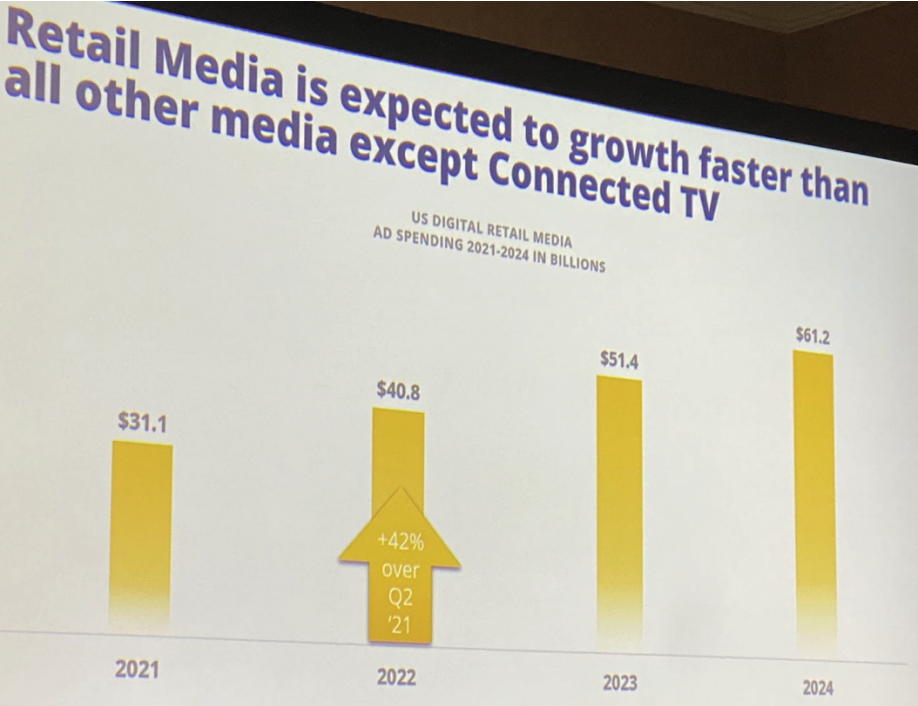

5. Retail Media

Kristi Argyilan, SVP, Retail Media at Albertsons, spoke about how Albertsons is approaching retail media as a relatively late mover. Argyilan stated that introducing retail media “significantly transformed” Albertsons—and there were advantages to its later entrance, such as already having the learnings of the marketplace and entering with new technology, not legacy systems. Argyilan emphasized that retail media should not be intrusive and should include personalized messaging. Argyilan concluded that retail media is serving Albertsons well: in only six months, Albertsons has seen significant growth in the results that the company is achieving for its clients.

Emily Frankel, SVP, Head of E-Commerce Marketing at PepsiCo, discussed how retail media can deliver personalization at scale. Retail media’s impact on sales is incremental; however, PepsiCo has identified issues in its execution and has been building a toolkit to address this since 2015. Frankel recommended that looking forward, retailers should not only consider lower-funnel sales objectives, but focus on the data that will enable retailers to better reach consumers.

Ethan Goodman, SVP, Commerce Media at The Mars Agency, also underlined the importance of accessing data, quantifying the impact of retail media and translating this into better connections with consumers.

Source: Coresight Research

Key Themes from Groceryshop 2022

In their review of Groceryshop 2022 on day four, the Groceryshop team (Krystina Gustafson, SVP of Content; Joe Laszlo, VP Content; and Ben Miller, Director of Original Content), identified five key themes throughout this year’s conference: inflation and the economy; redefining convenience; evolving brand and retailer relationships; engaging shoppers; and grocery tech trends.

Amid elevated inflation, retailers discussed how to respond to the challenging economic environment, including focusing on private label, introducing loyalty programs, promotions and delivery options that provide value, improving operational efficiency and building brand affinity.

Retail leaders also debated whether we are living through a once-in-a-generation redefining of convenience. Industry leaders offered various strategies to heighten consumer convenience, including making every customer touchpoint shoppable; being where customers are; and harnessing data. This engagement with data is of particular importance, since data is fundamental to understanding and responding to all shifts in grocery retail.

The role of retail media networks was a key focal point in discussion of the evolving relationship between retailers and brands. On day three, retailers and technology innovators discussed new tactics they are deploying to engage shoppers, including through livestreaming, personalization and social media. The top grocery tech trends discussed during Groceryshop 2022 revolved around achieving sustainability initiatives, efficiency of fulfillment and new product trials.

[ad_2]

Source link