[ad_1]

Михаил Руденко/iStock via Getty Images

Investment thesis

Turning Point Brands’ (NYSE:TPB) recent correction represents a major opportunity for long-term investors interested in highly profitable industries with long-term growth prospects. The potential of the company is immense as it is making strong expansion efforts in the vaping and CBD market, which are poised to grow at a very fast pace. It also has a leading position in the tobacco rolling paper market, which will also continue to grow due to recent trends in relation to smoking habits as smokers are slowly moving from industrial tobacco to rolling tobacco.

Still, the company is going through a rough patch: added to the 59% decline in the share price is increased debt, which greatly increases the company’s overall risks, and lower sales and EBITDA margins as a result of inflationary pressures. These three negative factors are basically what investors are exposed to in exchange for the opportunity to acquire shares at a low price, and in this article, I’m going to look at Turning Point’s chances of paying off its debt and holding out until inflationary pressures ease off considerably.

A brief overview of the company

Turning Point Brands is a leading manufacturer of branded products in the tobacco alternative industry with operations in the United States and Canada. It was founded in 1988 and its market cap currently stands at ~$430 million, making it a small-cap company.

Turning Point Brands (Turningpointbrands.com)

The company manufactures rolling paper and MYO (make your own) cigar wraps through the Zig-Zag Products segment, which provided 39.62% of the company’s net sales in 2021. Zig-Zag is the #1 premium and overall rolling paper brand in the United States, enjoying a market share of ~34%, and also enjoys the majority of the market share for MYO cigar wraps. The company also manufactures snuff and loose-leaf chewing tobacco through the Stroker’s Products segment, which provided 27.90% of the company’s total net sales in 2021. Turning Point Brands also distributes vapor products for the non-traditional retail channel through the NewGen Products segment, which provided 32.48% of the company’s total net sales in 2021. Turning Point Brands is entering the vaping market at a very fast pace by continuously expanding its presence in the e-commerce industry via acquisitions. The good profit margins typical of the alternative tobacco products industry make it possible for these acquisitions to be made in a sustainable way, that is, with cash generated through operations. In this segment, the company has also entered the cannabidiol (CBD) market by making a series of acquisitions in the industry since 2018. The company has recently acquired minority interests in diverse CBD-related manufacturers and is seeking growth in the CBD market both in the United States and Canada by making new acquisitions.

The company ships its products to around 800 different distributors and 200 indirect wholesalers within the United States and its products are available in ~195,000 U.S. and ~20,000 Canadian retail stores. The company is also expanding its operations through e-commerce channels.

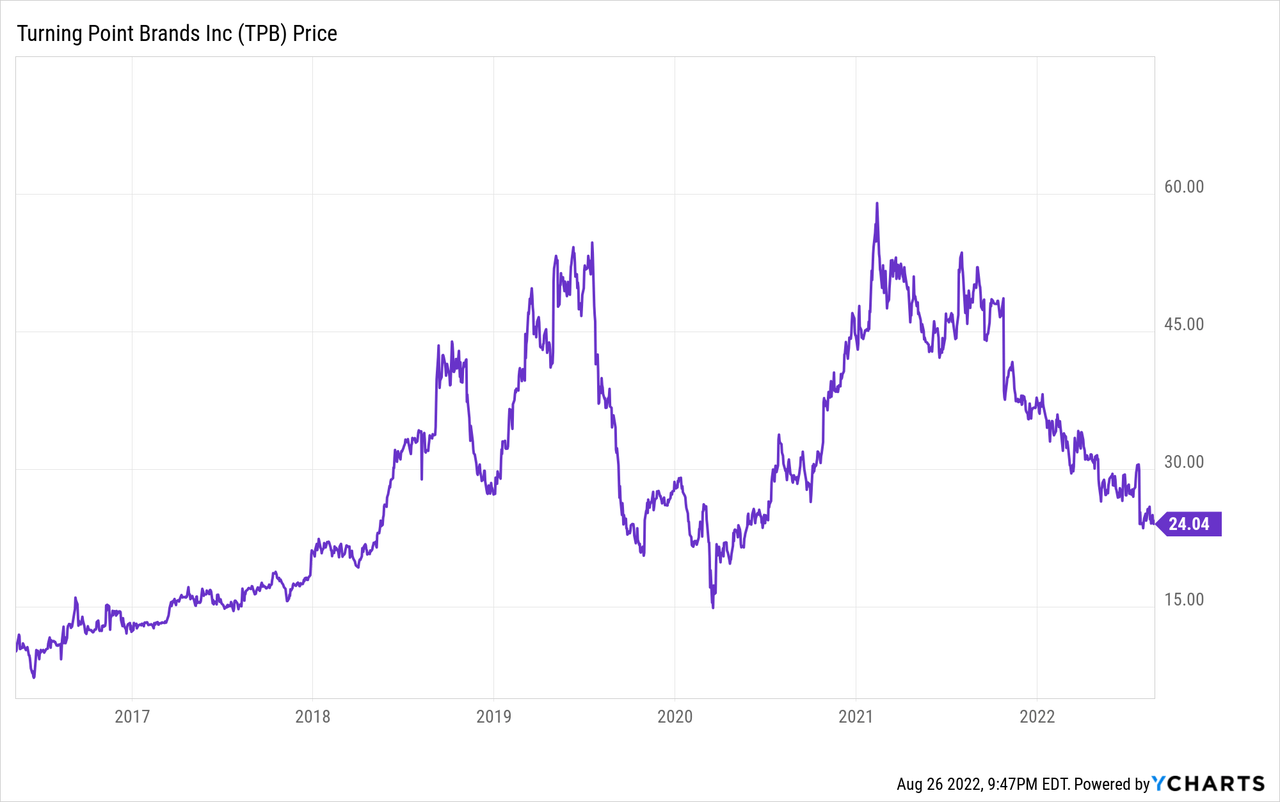

Currently, the share price stands at $24.04, which represents a 58.88% decline from all-time highs of $58.47 on February 21, 2021. This decline represents a good opportunity for long-term investors seeking rapidly expanding businesses in industries with high growth rates and at good prices. But this decline in the share price is of course not free of costs for investors as the short term looks very painful due to increased debt and lower sales.

To understand Turning Point’s growth rate and current debt situation, it is very important to review the acquisitions made in recent years.

Recent acquisitions

The company entered a phase of expansion via acquisitions, which have skyrocketed the company’s sales, but also the level of debt on the balance sheet.

In November 2016, the company announced the acquisition of four chewing tobacco brands and a twist tobacco brand from Wind River Tobacco Company for ~$2.5 million. These brands include Big Mountain, Appalachia, Black Mountain, and Springfield Standard, and enjoyed a market share of 2% in the chewing tobacco industry. Later during the same month, the company announced the acquisition of Vaporbeast, a leading e-commerce platform for e-cigarettes and e-liquids, for a total consideration of ~$27 million.

On June 30, 2017, Turning Point Brands acquired all of the issued and outstanding equity of Vapor Shark, and later, in 2018, acquired 7 Vapor Shark branded stores by purchasing and canceling the option granted to the former Vapor Shark owner for ~1.5 million.

In April 2018, the company acquired Vapor Supply, a business-to-business e-commerce marketing and distribution platform servicing around 1,400 vapor stores within the United States, generating ~$33 million annual net sales and gross profits of $6 million. Vapor Supply also manufactures proprietary e-liquids under the DripCo brand and operates eight company-owned stores in the Oklahoma market area.

In September 2018, the company acquired International Vapor Group, thus adding one of the top vapor business-to-consumer platforms to the Turning Point Brands’ portfolio and some new brands, including VaporFi, South Beach Smoke, and DirectVapor. The acquisition costed $15 million of cash, $5 million in shares, and a $4 million 18-month promissory note.

In November 2018, the company acquired a 19.99% minority stake in Canadian American Standard Hemp, which manufactures tinctures, capsules, topical products, vape cartridges, and oral sprays that contain cannabidiol isolate (“CBD”) through proprietary extraction technologies. After the acquisition, Turning Point launched Nu-X, a premium crafted CDB products company that manufactures CBG (Cannabigerol) flowers, and CBD-based gummies, shots, tinctures, gel capsules, lip balms, roll-on oils, pre-rolls, and hempettes. Nu-X also manufactures caffeine+B12 tablets.

In July 2019, the company acquired Solace Technologies, a developer of e-liquids with a leading position in the industry generating $10 million in net sales and $3 million in EBITDA during 2018, for $15.25 million. During the same month, it acquired a 30% stake in ReCreation Marketing, a Canadian distributor company focused on smoking, vaping, and alternative products categories, for $3 million. ReCreation serves around 30,000 traditional retail outlets and newly-established cannabis dispensaries across Canada. Turning Point used the platform to launch RipTide, which is a non-tobacco e-liquid vape technology, and sell products from the Nu-X Ventures’ portfolio. By 2021, it expanded the stake to 65% and its name was changed to Turning Point Brands Canada.

In June 2020, Turning Point acquired certain assets and distribution rights from Durfort Holdings and Blunt Wrap USA for $46 million. In the deal, Turning Point Brands acquired intellectual property rights of all Durfort’s and Blunt Wrap’s Homogenized Tobacco Leaf wraps and cones. In October of the same year, it acquired a 20% stake in Wild Hempettes LLC, a leading manufacturer of hemp cigarettes under the WildHemp and Hempettes brands. And during the same month, it also made an investment of $15 million in Dosist, a leading global cannabinoid company.

The acquisition spree continued during 2021 as it invested $8 million in Old Pal, one of the most recognizable and top-selling brands in the cannabis lifestyle space, through a convertible note, and another $8.7 million in Docklight Brands, another CBD-related product manufacturer. During that year, it also acquired certain cigar assets of Unitabac, LLC, which includes a robust portfolio of cigarillo products and all related intellectual property, including cigarillo non-tip homogenized tobacco leaf, rolled leaf, and natural leaf cigarillo products.

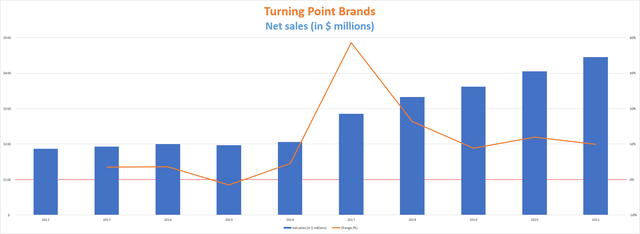

Net sales are experiencing explosive growth

Thanks to all these acquisitions, Turning Point’s net sales have increased steadily at an annual average of 16% during the past 5 years, although current trailing-twelve months’ net sales of $419 million represent a 5.95% decline from total net sales of $445.5 million in 2021, which has set off alarm bells among investors since it may suggest that Turning Point has serious difficulties to increase sales by itself.

Turning Point Brands sales (10-K filings)

The point is that inflationary pressures certainly had an impact on consumer traffic in convenience stores, especially for non-essential products. And although sales will fall to ~$420 million in 2022 as estimated, it is also estimated that they will reach ~$445 million by 2023, in line with 2021. In fact, the company operates in rapidly growing industries as the global cannabidiol market is expected to grow at a CAGR of ~16.8% from 2022 to 2030. The global e-cigarette and vape market size is also expected to grow at an astonishing CAGR of 30% from 2022 to 2030. Also, it signed an agreement with Flamagas for exclusive distribution of CLIPPER lighters, the number one reusable lighters brand in the world and the number two overall world lighter brand, in the United States and Canada.

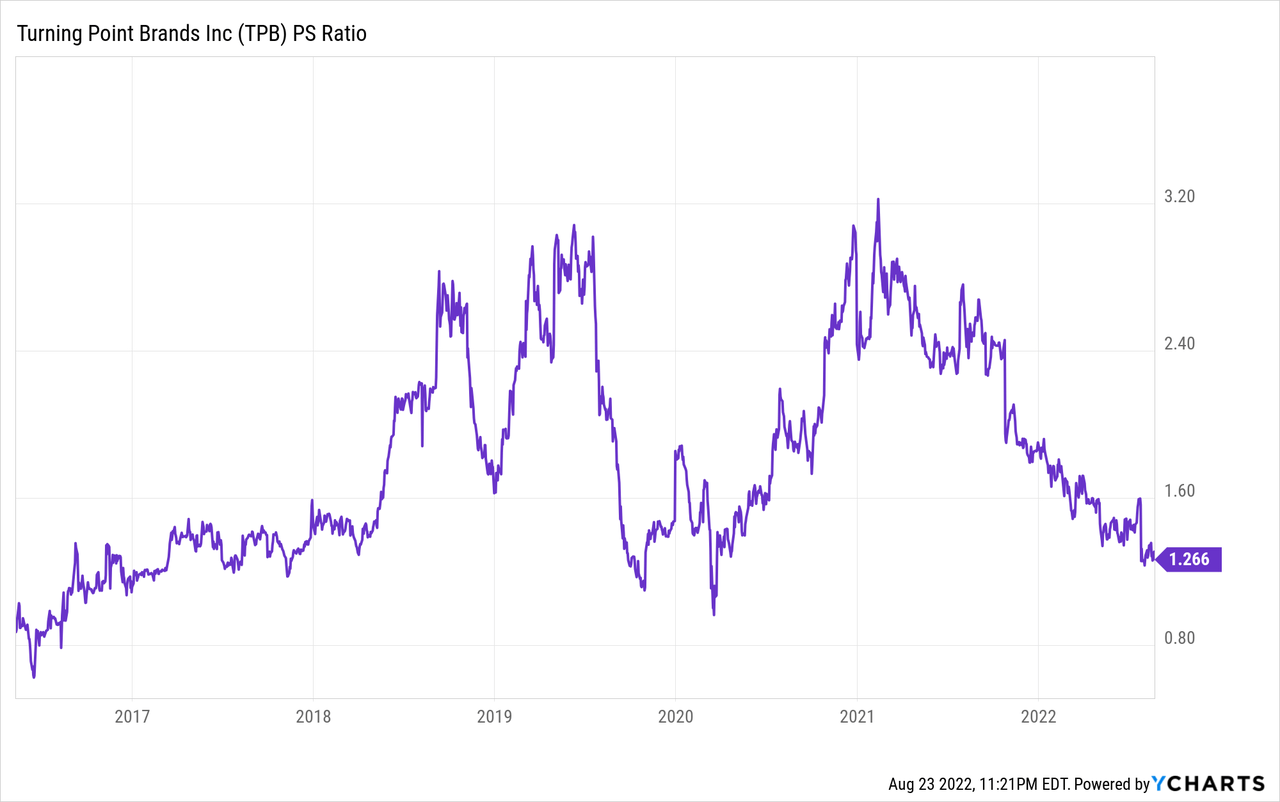

The good point is that although sales have fallen recently, the share price has fallen even more, which has caused a considerable drop in the PS ratio as investors are not as willing to pay as much as before for the company’s sales due to the deterioration of its operations and the high risk involved in the debt contracted to carry out the latest acquisitions.

In this sense, the PS ratio currently stands at 1.266. This means the company makes $0.79 for each dollar held in shares by investors, annually. Honestly, I consider that the ratio is very low if we take into account the enormous profit margins that Turning Point Brands has and the rapid pace of growth that it has experienced in the past few years.

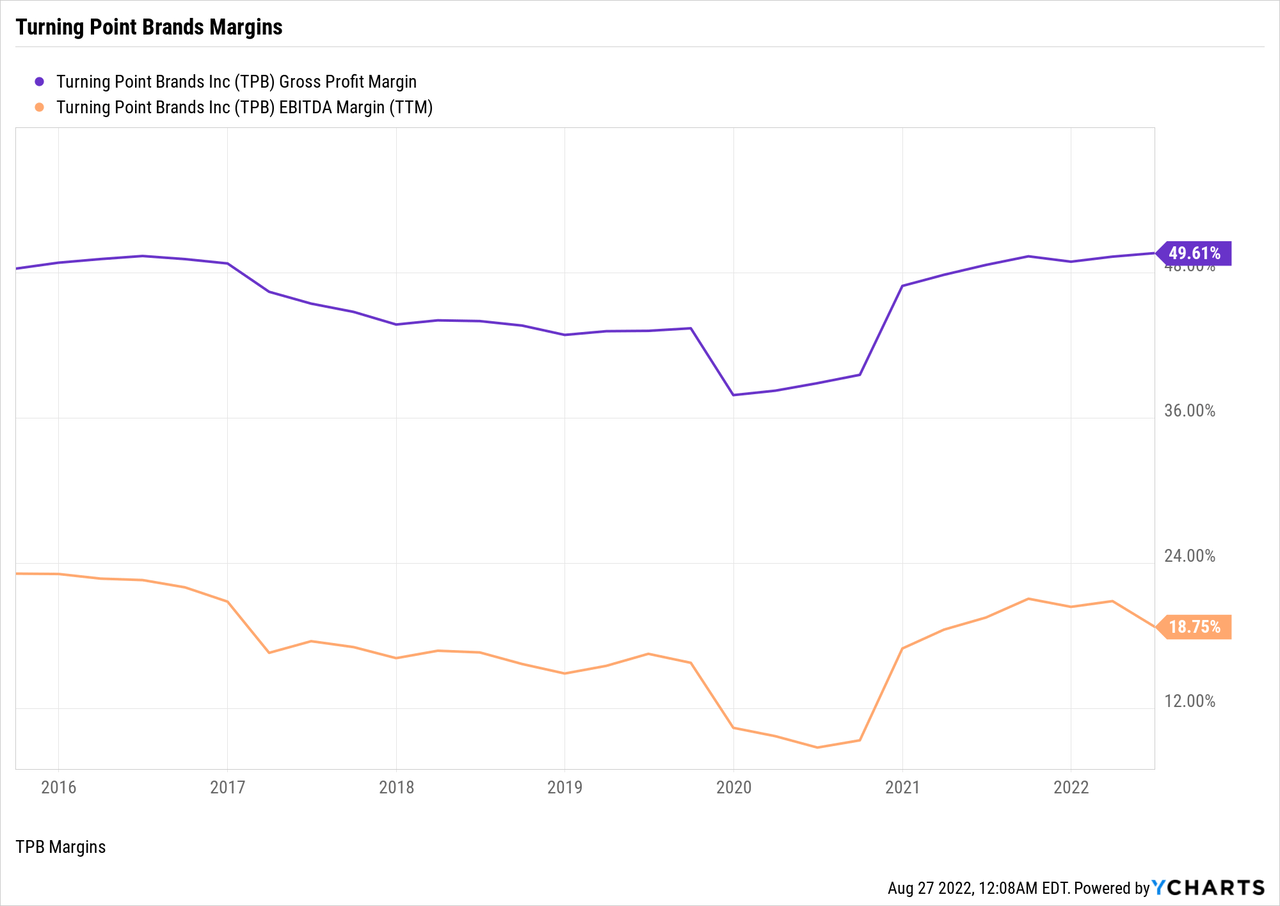

The company’s margins are actually very high

The company historically enjoyed gross profit margins of over 35% and EBITDA margins of between 10% and 20%. During the second quarter of 2022, the company’s gross profit margins were 50.01%, which is a slight improvement from the trailing twelve months’ gross profit margins of 49.61% due to a decline in lower-margin NewGen sales produced by inflationary pressures. EBITDA margin of 12.88% during the last quarter suffered the most as it is much lower than the current trailing twelve months EBITDA margin of 18.75%.

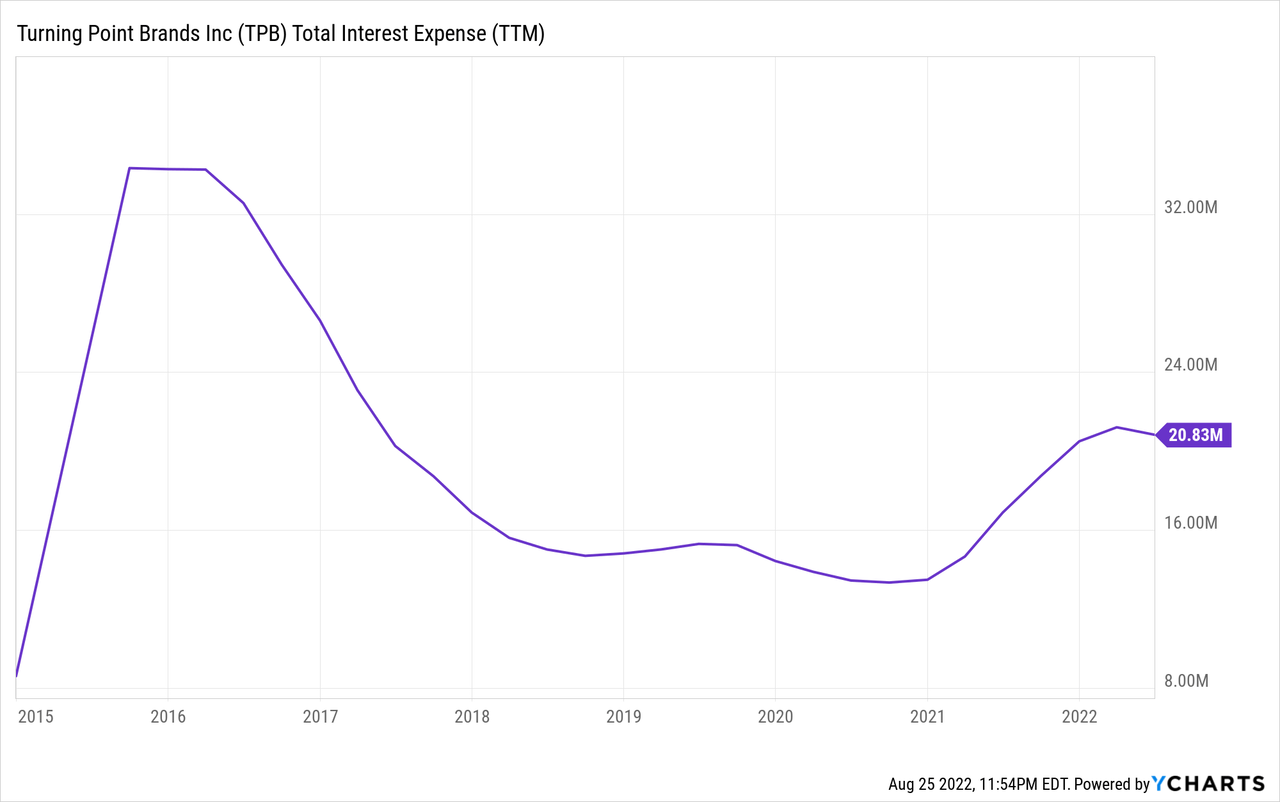

During the Q2 2022 earnings call, CEO Yavor Efremov stated that the company is taking cost control measures to reduce operating expenses and restructuring the CapEx structure in order to protect cash flows for 2022. The company is also fusing its 4 ERP (Enterprise Resource Planning) systems into just one, which should improve efficiencies. But as of now, it is actually the interest expenses derived from the debt contracted to carry out the aforementioned acquisitions what is consuming a large part of the company’s cash from operations.

Debt keeps accumulating and interest expenses are already too high to keep up with acquisitions, dividend raises, and share buybacks

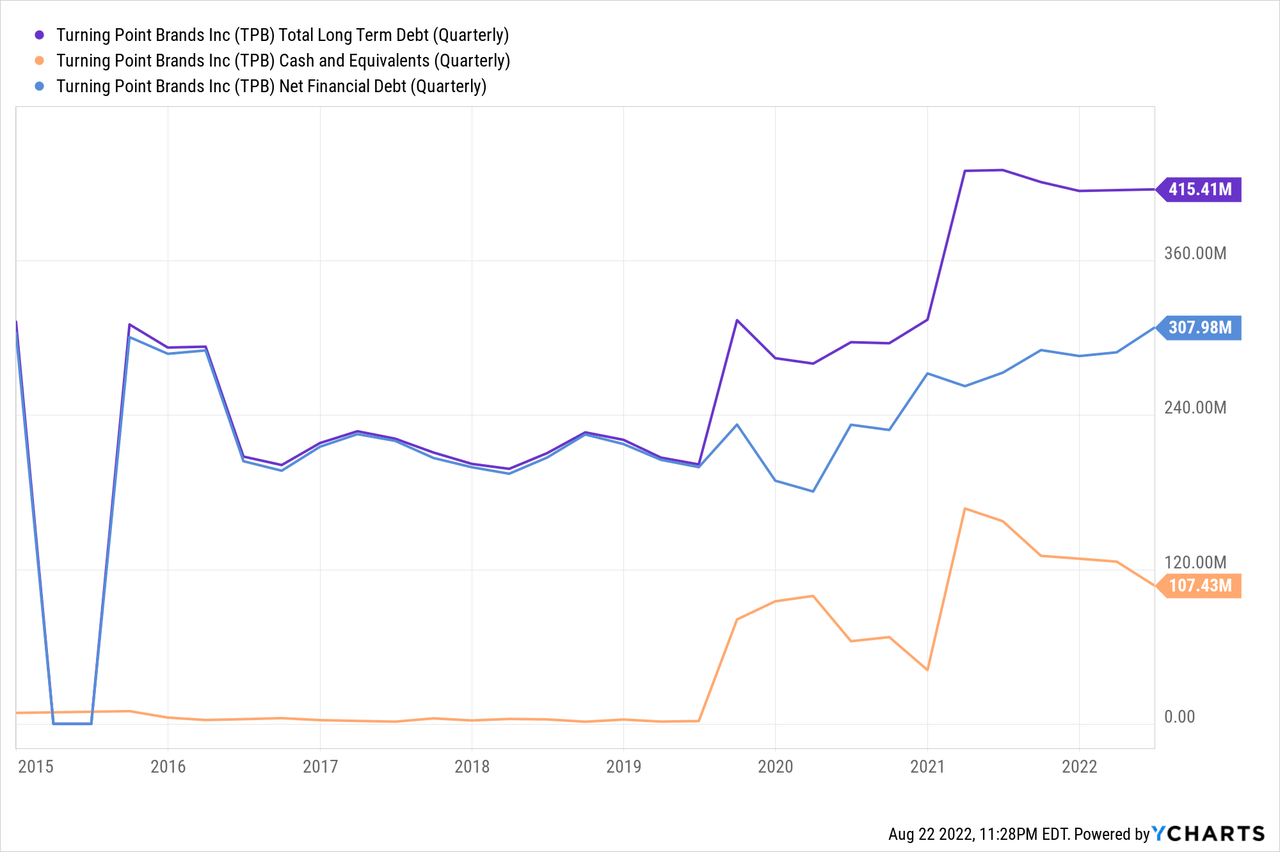

The recent explosive growth experienced during the past few years has been based on debt usage as dividends, interest expenses, and share buybacks took almost all the cash generated through operations. In this sense, the company currently carries a long-term debt of $415.41 million and cash on hand of $107.43 million. Thus, its net debt currently stands at $307.98 million.

This increase in debt is causing an increase in interest expenses, with which the ability to continue growing at the rate at which the company was doing is increasingly limited. It is very important to understand that the growth has been unsustainable as the company has also returned cash to investors via dividends and buybacks while making aggressive acquisitions, and that sooner rather than later, Turning Point Brands will enter a deleveraging mode, if not by desire, then by necessity.

The increase in interest expense has a very negative effect on the company’s operations due to various factors. In the first place, new acquisitions and dividend growth will be, from now on, strongly limited by the expenses that carrying such debt entails each year. Second, the risk of a headwind making the business unviable is greater as the interest expense grows. This is so because the company now has an obligation to respond to these interests, which are increasing at an unsustainable rate. Therefore, I strongly believe that a stage marked by lower growth, lower dividend raises, and lower share buybacks is approaching. But I also believe that this new stage will begin to bear fruit very soon thanks to the company’s great ability to cover dividends and interest expense year after year through cash from operations.

The dividend may suffer in the short term, but its growth potential is surprisingly high

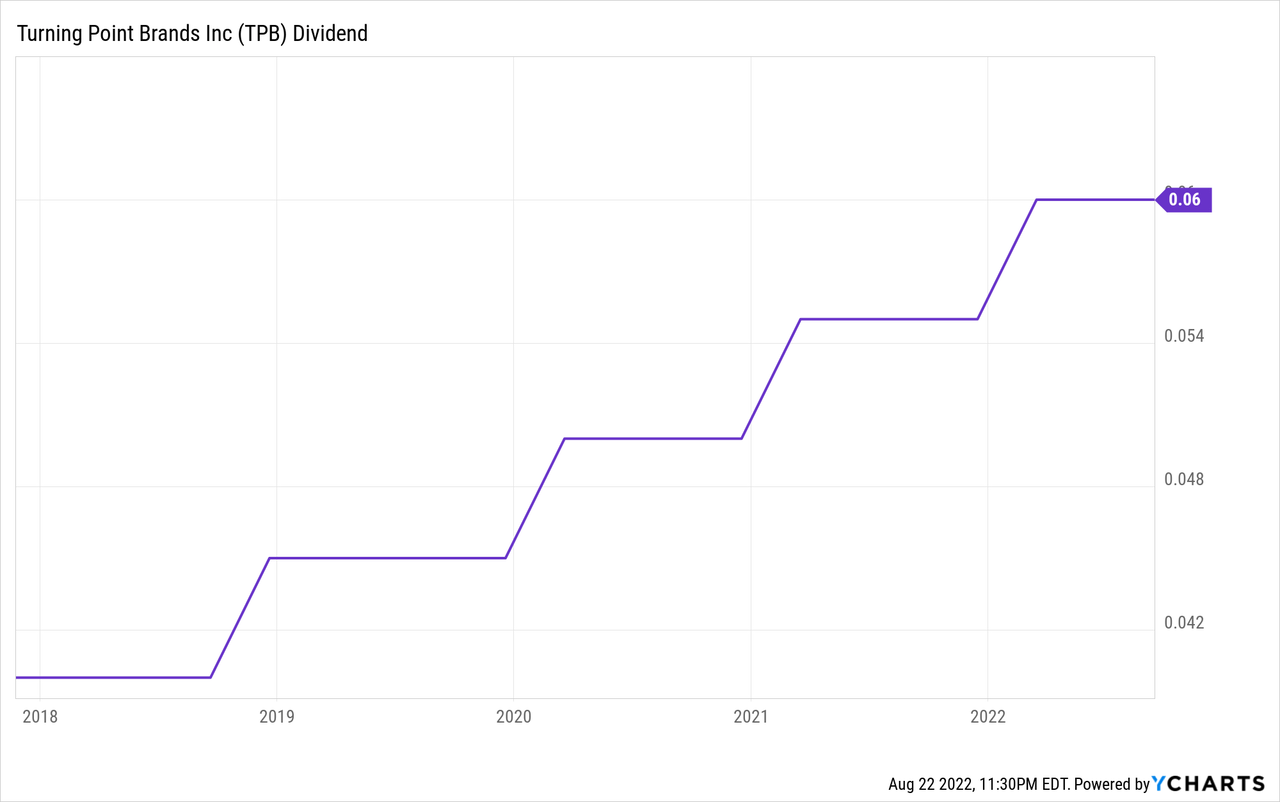

During the fourth quarter of 2017, the management decided to set a quarterly dividend payout of $0.04 for shareholders and, since then, it has slowly raised it to $0.06 per quarter.

Next, I’m going to calculate the company’s ability to cover its dividend and interest expense. I have decided to do it by calculating what percentage of the cash from operations is allocated to the payment of the dividend and the interest expense, since in this way we will know if the current operations of the company, as well as the dividend, are sustainable.

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in $ millions) | $29.69 | $13.09 | $37.80 | $43.68 | $68.22 |

| Payment of dividends (in $ millions) | $768 | $2.32 | $3.53 | $3.80 | $4.10 |

| Interest expense (in $ millions) | $16.91 | $15.09 | $14.44 | $13.48 | $20.50 |

| Cash payout ratio | 59.52% | 132.96% | 47.54% | 39.58% | 36.06% |

Even after covering the current capital expenditures of ~$20 million, the company has enough resources to cover the dividend and reduce its debt position as it has a very low cash payout ratio, although at the moment the management is more inclined to reduce the total number of outstanding shares. Furthermore, current trailing twelve months’ cash from operations of $38.0 million is enough to keep covering all the company’s expenses considering inventories increased by $18.7 million in the first half of 2022 while accounts payable only increased by $7 million.

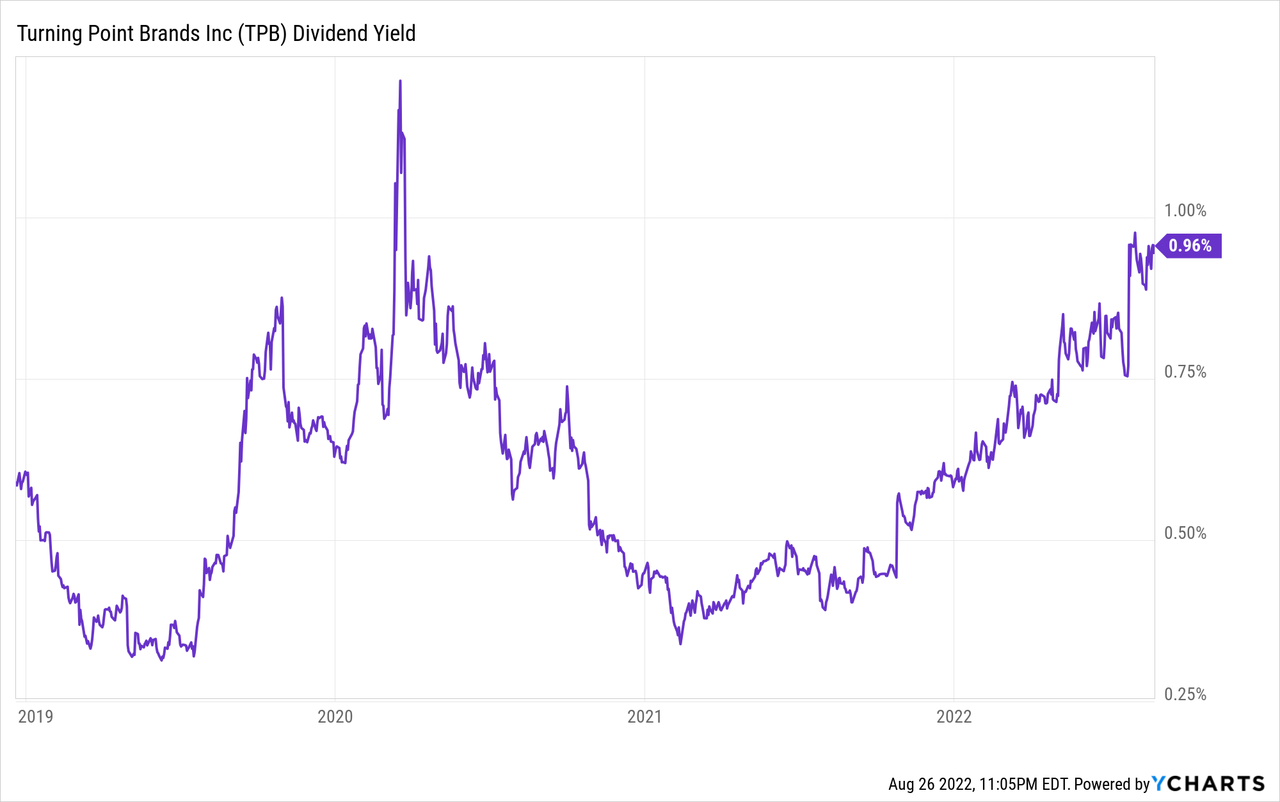

The recent decline in the share price has caused an increase in the dividend yield, which currently stands at 0.96%.

This dividend yield is much higher than in recent years, and although it may seem very low, it is important to point out that the company has a lot of room to improve it in the future: first, current interest expenses are equivalent to five times the dividend expense, so once the debt is reduced, the dividend can be increased enormously. Second, the company has reduced the number of shares outstanding at a fast pace since the beginning of 2020, with which the dividend growth has been actually replaced by share buybacks to a large extent.

Share buybacks are being paid with debt

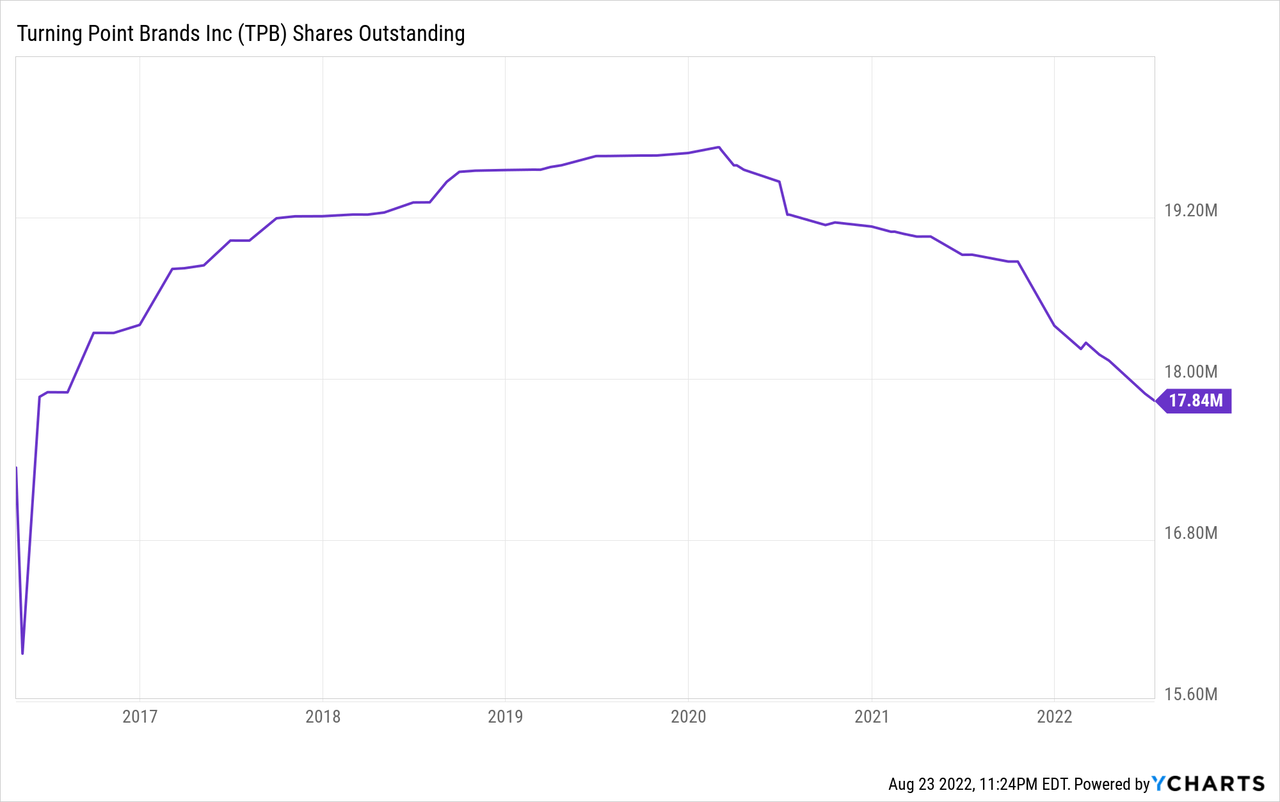

In February 2020, the company announced a $50 million share repurchase program, and in 2021, it expanded the authorized share repurchases by another $30.7 million. Since these two repurchase programs were authorized, the amount of shares outstanding declined by 6.59% from 19,095,559 in February 2020 to 17,837,402 in July 2022.

This means that each share of the company represents a larger and larger portion of the company, which improves the per-share metrics without necessarily improving the total company metrics. The actual problem with this is that these repurchases are being made based on debt, since all the cash destined to repurchase the shares is cash that is not being used to prevent it from increasing.

Risks worth mentioning

The company has increased its debt load significantly in recent years as it has expanded through acquisitions. Aggressive share buybacks are also responsible for this increase in debt. Interest expenses are increasing as a result, which will considerably reduce the company’s capacity to keep growing, performing buybacks, and raising the dividend, and will certainly increase the overall risk of viability issues in case of prolonged headwinds.

A decline in consumption of alternative tobacco products or rolling tobacco would have a direct impact on the company’s operations. Despite this, it is important to emphasize that the global rolling tobacco industry is expected to grow at a CAGR of 4.1% from 2022 to 2030 and, as I have mentioned before, the CBD and the vape industry will show explosive growth in the coming years.

Also, the CBD market is susceptible to suffering from the introduction of black market CBD products, which can circumvent laws that limit the capacities of CBD products and taxes, which could result in unfair competition. The cannabinoid legalization trend in the U.S. and Canada could also reverse, and it would be definitely disastrous for the company’s operations.

And finally, I would like to remind that recent growth has been achieved largely thanks to the acquisitions carried out in recent years. Turning Point Brands has yet to prove that it can maintain the health of the acquired companies’ operations and the loyalty of customers to the acquired brands, something that is much harder said than done.

Conclusion

It is obvious that the situation at Turning Point Brands is quite complicated, and proof of this is the 59% share decline suffered in just a year and a half. Recent inflationary pressures are limiting the company’s volumes, and it is directly impacting to the company’s EBITDA margins and sales. The company is about to move to a new phase marked by the maintenance and improvement of its operations and cash preservation. After all, if the management wants to get rid of part of its debt pile in order to keep up with growth soon, it will have to temporarily reduce the amount of future share buyback authorizations or stop them. Dividend raises should also be paused, and acquisitions should be done less frequently, at least until debt becomes more manageable. If the management does not do it on its own initiative, it will be the interest expenses themselves that will force them sooner rather than later.

Despite this, we must not forget that Turning Point Brands is a very profitable company with very high margins and a good ability to generate cash. The managements’ margin to improve the company’s prospects is very high since it only has to temporarily cut part of the cash returned to shareholders (reduce share buybacks) and reduce the pace of acquisitions while recent headwinds ease. Therefore, I believe that this represents a great opportunity for long-term investors, because although the pain in the short term is going to be high, it is to a greater or lesser extent priced in and the company has enough margin to keep its debt position under control while in the long term everything points to the industry in which operates will continue to grow and Turning Point Brands will keep generating vast amounts of cash that will ultimately result in a high yield on cost based on current prices.

[ad_2]

Source link